If you’ve been reading a newspaper, turned on the TV news or looked at the internet, you will probably have seen a lot of talk about major economies heading into a recession.

While this sounds like a scary prospect, it’s not a new thing – they’ve been going on for a long time and are a regular occurrence. In fact some economists say that they’re part of the natural economic cycle and are necessary to help grow the economy and keep it in check.

Table Of Contents

- A (Very) Brief Overview Of How The Economy Works

- What Is A Recession?

- What A Recession Is Not

- What Are The Causes Of A Recession?

- How Can You Spot A Recession Coming?

- How Can Recessions Affect You?

- What Happened During Previous Recessions?

- How Being A Global Economy Has Affected Recessions

- How Do You Prepare For A Recession?

- How Do You Know A Recession Has Ended?

- Why Is The Predicted 2022 Recession An Anomaly?

- Conclusion

So what is a recession really? What effect can they have on everyday folk? What’s happened in previous recessions and what is so special about the predicted 2022 recession that has experts confused?

We’ll cover all of this in the article below, but first it’s important to understand how the economy usually works so we can understand the causes behind a recession and its knock-on effects.

A (Very) Brief Overview Of How The Economy Works

I’ll put this in simple terms as I don’t want to blind anyone with confusing statistics, equations or mathematics.

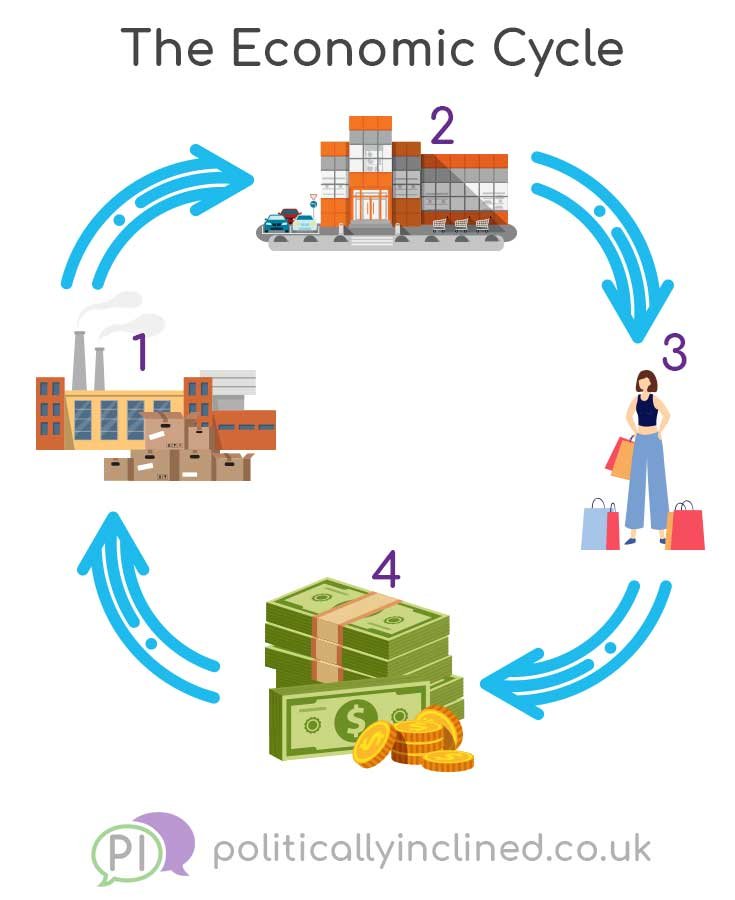

In the most basic of terms, the economy can be split into 4 processes:

- A company manufactures goods or provides something of value (a service)

- That company sells their products to a retailer or a service direct to the consumer

- The product or service is purchased by the customer

- This generates capital which is put back into the business, this capital is then used to manufacture more good or provide their services. When a business has made sufficient money they can expand their output and increase staffing levels.

A healthy economy has a good flow of money. People put money into their business to increase manufacturing output or expand into new markets, this in turn opens up new job opportunities and more people can enter employment.

These employed people can now spend their wages on products and services generated by other businesses which drives the cycle around again.

If businesses are feeling the purse strings tighten and aren’t raising wages, employing people, cutting hours or laying them off then there is less money for consumers to spend due to lower wages and the cycle begins to shrink which indicates the start of a recession.

What Is A Recession?

While there is no definitive term for a recession (it depends on who you ask, where they are based and what type of economist they are) most sources agree that:

A recession is triggered after decline in GDP for two consecutive quarters

In layman’s terms, that means that the total value of goods produced and services provided in a country goes down in terms of outputted value across a 6 month period.

If a recession affects one market sector – for example the hospitality sector due to businesses being closed because of a pandemic (wonder where I got that example from) – this is known as a “technical recession”.

A “true recession” affects all market sectors – i.e. hospitality, manufacturing, service industries etc. will all see a downturn in profits and output.

In the United States, the National Bureau of Economic Research (NBER) says that there may be signs of a recession even more the 6 month dip in GDP and they take a look at a variety of factors to see economic trends which may indicate if a recession is likely.

NBER takes into account:

- Real Income i.e. the take home pay of employees. If this is dropping or not keeping up with inflation then people will have less money available to spend

- Employment Rates – the hours worked, the number of staff being laid off and those in full vs. part-time employment. If a company is not confident about future orders for example, they may cut hours or lay people off to save money

- Manufacturing Output – this will start to drop if people are putting in less orders which may happen due to a lack of confidence in the market or reduction in cash flow

- Retail Spending – how much are people spending on non-essential goods and services? If people have less disposable income (due to less work or because they are saving more) retail spending will decline.

Some economists also look at business and customer confidence as a measure of whether we’re entering into a recession. They’ll look at things like jobs, number of things being built (homes, business premises etc) and stock market (prices, volatility). If the figures for these are stable or rising then it shows that people are confident in the economy. If figures for these it shows people are not so confident and may start to tighten their belts signalling a recession may be on the way.

What A Recession Is Not

It’s important to note what a recession isn’t. If a country’s output isn’t growing but it isn’t declining, this is classed as “stagnation”.

A recession isn’t the same as a “depression” either. A depression is a decline that last multiple years whereas a recession is typically shorter term. A depression also sees a significantly higher unemployment rate (25+ percent) than in a recession (10+ percent).

You might also hear people use the phrase “contraction” when talking about the economy. This indicates that GDP isn’t growing as expected (or in some cases is falling) however the 2 quarter (6 month) threshold hasn’t been met in order to call this a “recession” yet.

What Are The Causes Of A Recession?

There are several reasons that a country might begin to experience a recession. Some may be down to factors in their own economy and some may be down to another country’s economy due to the globalised world we now live in.

Let’s break down the main causes of a recession that are in a country’s control:

Inflation

Inflation is probably biggest cause of a recession. Simply put, inflation means that costs of goods and services increase meaning it costs more to buy or access things. This reduces the spending power people have and this then reduces cash flow into the economy, shrinking the economic cycle – especially if wages aren’t rising with inflation.

When inflation rates are high, people will tend to wait to make a purchase hoping that the prices will go down in the near future.

High Interest Rates

When interest rates are high, the cost of borrowing for business is expensive, it’s more difficult for people to get an affordable mortgage and loan repayments increase due to the higher interest rates being charged by the banks and lenders.

People more likely to put money into savings to get a better return on investment than putting it into the economy. People & businesses save more, borrow less and as a result have less money to put back into the economy.

Consumer Confidence

This is a statistic that’s tracked by some economists. As we mentioned above, it’s how people feel about the state of the economy. Low confidence means they’re worried and less likely to splash out on luxury items and just stick with the essentials.

Factors affecting consumer confidence include job security, how their investment portfolio is doing, value of property vs mortgage value etc.

Asset Bubbles

Another part of Consumer Confidence are “Asset Bubbles”. As people become confident in an item such as the stock market or property this causes the price to rise but it is usually unsustainable.

People try to get out while the going is good and sell off everything causing the bubble to burst (think Dot Com bubble in the early 2000s which we’ll look at later).

Slow Down In Manufacturing

Economists track manufacturing processes such as order levels, how much is actually being produced, inventory levels, how much is delivered and how much it’s all costing. If output drops while costs rise then businesses are less likely to expand and will keep a hold of their cash.

It’s also an indication that consumer demand is reducing hinting that there’s less money in the economy available.

External Factors

As mentioned briefly above, there may be external factors to blame that start a recession in one country before moving it to another.

A recession in one country can create a massive knock-on effect in others which we saw happen in 1997 in South East and East Asia, or in the US in 2007.

1997 value of Thai Bhat collapsed. Investors lost confidence and moved their money out of the country, this had a knock on effect to other countries in the region as they were no longer receiving funds and investments from Thailand and other countries who now considered the region a risky place to invest in.

This had the effect of reducing investment into many Global South countries causing inflation to rise and recessions to begin.

In 2007, the US housing market crashed which caused massive ripples around the financial sector across the world. US banks defaulted on loans made by European banks, who defaulted on loans made by Asian banks, the repercussions were massive.

Because the banks themselves had no cash available to lend, this meant that businesses couldn’t get credit to expand, consumers couldn’t get credit to purchase a house or luxury items and economies around the world ground to a halt pushing us into a global recession, now known as the “Great Recession”, in 2008.

It was only due to a massive package of bail-out money from Governments that the banking system was saved and able to start the lending process again, therefore restoring the ability to provide credit to companies allowing the economic cycle to start up again in 2009.

There are also additional issues such as trade wars and trade embargoes – we saw this most recently between the USA and China which saw Chinese manufacturing output cut dramatically as they could no longer export certain goods to their biggest market – the USA.

This then impacted Germany, whose largest economic sector is manufacturing. Because China needed less parts and materials, Germany’s manufacturing output fell which had a further knock-on effect across the Eurozone with smaller businesses who supplied German manufacturers affected.

How Can You Spot A Recession Coming?

Some economists say that the manufacturing sector is a good indicator of what is happening with the economy due to the way that they manage their order books.

Orders are normally booked months in advance, if a manufacturer stops getting orders they’ll stop hiring new staff, cut down on available hours or lay people off which gives prior warning a downturn is on the way.

If this happens it is a good indicator other parts of the economy will start to slow as well due to the way that so many people rely on the manufacturing sector as part of their production stream to run their business.

As an example, if people don’t have spare money splash out on a man who fits luxury kitchens, he’s not going to place as many orders to his wholesaler. The kitchen wholesaler will look at the falling demand and reduce orders to their cabinet, sink and worktop suppliers indicating there is a downturn on the horizon.

Another indicator is how people are investing in Government Bonds. If they have confidence that the economy is okay they’re more willing to invest in publicly traded companies on the stock market. If they think the economy’s slowing down they’ll pull their money out of stocks and place them in Government bonds which are seen as a more stable (and safe) investment.

How Can Recessions Affect You?

You might think that a recession will only affect businesses that want to expand, or people who invest in the stock market but there are wider ranging impacts to be seen that affect almost everyone.

Let’s say we have Company A that makes a product called “Widget Q“.

Widget Q is considered a luxury item, not a staple product everyone needs.

Inflation increases, and wages are stagnant so people stop spending as much, this means that Company A isn’t selling as many Widget Q‘s as before.

Company A lowers the production numbers of Widget Q

This means that Company B who provides components for Widget Q isn’t selling as many parts so has to reduce output as well

Company C, who stocks Widget Q isn’t getting as much stock through as before, plus the stock it has is selling slower than usual, and it has less customers in general as there’s no spare cash to spend.

Because they’re not selling as many Widgets, Company A lays off workers.

Company B also puts workers on part-time hours (reducing their wages) due to a reduction in output.

Company C closes as no one is buying Widget Q any more and the haven’t got any cash to purchase alternative stock.

Because Companies A, B and C have laid off workers or reduced their hours the employees (or ex-employees) also have less money to spend meaning that restaurants and shops around their areas will see profits drop and service industries like decorators would see a decline in business as people can’t afford to employ them.

Due to the number of businesses closing and no one is able to take over the premises, the area begins to lose appeal. This means that people living in the area will see their house prices dropping as the area isn’t desirable as it once was.

People may no longer be able to afford to live there now so sell up, losing money on their houses due to the decrease in market value.

Because so many people are leaving the area, local government reduces spending on local services and amenities meaning that a small school and a swimming pool close and the library is only open part-time hours.

This reduces house prices even more continuing the cycle.

Now imagine that’s across hundreds of towns and cities, across thousands of different business models and you can see what a massive impact a recession can have on both the wider economy, business sectors and people employed within these sectors as well as the local economy as well.

What Happened During Previous Recessions?

Between 1960 and 2007 there were 122 recessions in 21 “advanced” economies – they were in recession around 10% of that 47-year period with the average recession lasting about a year.

Each recession is different, but these previous ones share the same basic 3 indicators:

- GDP fell around 2% and even as much as 5% in severe cases

- Investment, industrial output and import rates dropped

- There were issues within financial markets – volatile pricing, fluctuating markets, people selling (see the “asset bubble” above)

Apart from the “Great Recession” of 2008 there have been a couple of notable ones during the previous 30 years.

The early 1990s Recession (also known as the Gulf War Recession which

lasted 8 months in 1990-91) was caused by the end of the Cold war, this saw a reduction in spending on defence in the US which had an affect on weapons manufacturers and suppliers around the world. Economic expansion in the US had been limited due to the Federal Reserve trying to curb inflation which caused business and consumer confidence to plummet. This was coupled with a massive increase in the price of oil due to the Iraqi invasion of Kuwait which further increased manufacturing costs causing businesses to shed jobs or shut down completely.

The “Dot Com” recession (2001 lasted 8 months). If you’ve been near a PC you’ve probably heard of the “Dot Com” bubble. In the late 1990’s and early 2000s investors couldn’t get enough of tech stock. From Netscape and eBay to AOL Time Warner, people were pumping billions into companies that didn’t have any physical products – and some didn’t even have a working website or product at all.

After a few companies were shown to be more like the “emperor’s new clothes” than the next tech revolution, investor confidence tanked and the bubble burst.

Because so many companies had investments in Dot Com stock – or companies they invested with did, this greatly reduced available capital so investment and expansion stopped leading to a recession in various countries which soon bounced back once the market corrected itself.

While it may be worrying to hear that we’re heading into a recession, this is usually a short-term economic “blip” that rights itself quickly, although 2022 may be a little different but more on that in a moment.

How Being A Global Economy Has Affected Recessions

As we saw in our earlier examples from 1997 and 2007, a financial issue in one country can create a butterfly effect that ripples to other countries seemingly not even tied to the one where the financial crisis is occurring.

Because of the globalised nature of economies causing so many issues even before 2007/8, this has now caused countries to focus on internal growth rather than worldwide trade, this may lead to more recessions as a country (or business/market sector) would not have the backing of other stronger economies to bolster them if they began to falter due to inflation or high interest rates in their own country

This process is known as deglobalisation and it’s something we’re seeing more often – think of the USA becoming less independent on China or the UK pulling back from the EU with Brexit.

While deglobalisation can protect a country from a recession that occurs in another country, it does mean that they have fewer places to turn for investment or to purchase goods they manufacture which would give the economy a much-needed boost so the process is rather a double-edged sword.

How Do You Prepare For A Recession?

Firstly, I am going to say that I am not a financial advisor or an economist, I am just someone who likes to read a lot of random articles on the internet so the following comes with the disclaimer that this is not financial advice and you should speak with a licenced professional in order to discuss your specific financial situation. With that being said, here’s a few things you can consider to recession-proof your finances:

Increase Your Savings

If you’re already able to put some money away each month, try to increase the amount – especially as interest rates rise. This is assuming the banks pass some of the interest rate increase on to customers of course

Emergency Fund

Keep an emergency fund so you can cover X months’ worth of bills in case you become unemployed or have your hours cut. How much you will need to put away will depend on how much your current outgoings are, what savings you have and what you can afford to put to one side

Tighten Your Purse Strings

Look at your budget and cut costs where possible so you are able to put money into your emergency fund. Do you really need to go out once a week for a meal? Cut that down to every other week and save what you would have spent eating out.

Start Paying Off Priority Debts

Pay off those with the highest interest rates first as your repayment amounts will go up due to the rise in interest rates. Maybe think about a debt management scheme or loan consolidation which could help reduce the interest rate total. Look at lower rate credit cards or ones with free balance transfers and zero percent interest which sometimes run as an introductory offer.

Diversify

Make sure you diversify your pension and investments – don’t keep it all in volatile stocks and shares, look to other ways such as government bonds which are more stable.

Ironically these are all drivers of a recession – whoops! Yes, by cutting spending and saving more you will be taking money out of the economy which will then drive the recession cycle but it’s better to recession proof your finances now then be in a terrible situation if/when it fully kicks in.

How Do You Know A Recession Has Ended?

Eventually production begins to increase, people begin to spend more and more money goes back into the economy – people go to restaurants again as they have a bit more spare cash, they buy more expensive items which kickstarts a “recovery” phase.

Because of the recovery phase, businesses are able to employ more people and the circular economic process starts all over again.

Why Is The Predicted 2022 Recession An Anomaly?

The Pandemic has created an odd shift in the economy with a recession being created due to a virus, not due to a lack of money available.

People lost their jobs due to businesses being closed under COVID restrictions, not because of an economic downturn.

Governments across the globe poured money into schemes to help keep business in a position where they could keep people employed until they were able to reopen and people had money coming in via furlough schemes etc. which helped the economy bounce back.

During this time a lot of people took the opportunity to reflect on their life and their jobs and many changed careers so employment levels are growing at a very high rate thanks to the bounce back from the pandemic.

But GDP is dropping despite businesses now being pretty much fully open. But why? You would usually look at a dropping GDP and see that job figures are also declining as businesses reduce staffing levels but this isn’t happening in 2022, making the start of this recession (if that’s what is happening) an odd stand out from recessions in the past.

Why is this happening? Why are job figures not falling along with a decline in GDP?

A rise in self-employment, the ability to work from home and jobs in the “gig” economy such as food delivery services due to the pandemic meant that people were able to get into work that they may have not normally thought about as a viable job prospect.

This has meant that there are vacancies available that weren’t there in the job market before, it also means that companies are fighting to employ workers leading to increased wages, meaning even more people are interested in certain types of employment.

Also, a lot of people took the pandemic as a sign that they should retire meaning that there were even more spaces available for people to enter the workforce at a variety of levels.

Previous recessions had “jobless recovery” where GDP increased while employment levels stayed the same or continued to decrease. 2022 is the opposite – GDP is shrinking while the employment figures are growing.

However there’s an interesting twist. According to the Consumer Sentiment Index, this is showing that people are as unhappy with the economy as they were during the 2008 “Great Recession” which shows that they have low, low, low confidence in the economy.

As a result, people are spending less which caused the reduction in GDP, however people are still employed thanks to the bounce-back effects of the pandemic.

This is in addition to the fact that many businesses are reporting that their 2022 profits are in double digits unlike previous recessions meaning that they have the capital there to keep their business going and maybe weather the predicted 8 month to a year “blip” without having to lay off staff.

Conclusion

Whichever economics method you go by, it looks like recessions are a regular way of life and something we all need to be prepared for.

We will always have a cycle of growth and then contraction, of boom or bust however with lessons learned from both 2008 and 2020 perhaps the impacts on local and global economies won’t be as severe, wide ranging or as long lasting as they have been in the past.

Maybe the strange anomaly of the predicted 2022 recession is a sign of things to come, that GDP will drop indicating a recession but that they job market will remain stable, if not buoyant.

One thing to be seen though is how the impact of high inflation rates and the cost of living crisis will impact economies as people are now living on far less money and are barely able to afford even essentials.

Unless governments step in to curb the rampant increase in energy prices which has a knock-on effect across every sector, and with consumers having little-to-no disposable income, 2022 may just become “The Great Recession 2.0”.

Resources:

- What Is A Recession? – Illustrate to educate (YouTube)

- What Is A Recession| CNBC Explains (YouTube)

- What Is A Recession? – IMF (YouTube)

- Why a 2022 Recession Would Be Unlike Any Other | WSJ (YouTube)

- Snopes: Did the White House Change the Definition of ‘Recession’?

- The Economic Times: How do you define a recession? Let us count the ways

- Wikipedia: Global North and Global South

- International Monetary Fund: Recession: When Bad Times Prevail

Images:

- Illustration of financial crisis by starline on Freepik.com (featured image)

- Cycle arrows by pch.vector on Freepik.com

- Illustration of a Supermarket by Macrovector on Freepik.com

- Illustration of Industry by pch.vector on Freepik.com

- Illustration of cardboard boxes by carrys_82 on Freepik.com

- Illustration of various forms of money by tartila on Freepik.com

- People buying things holding shopping bags by pikisuperstar on Freepik.com